A better option for sovereign wealth funds to invest in major financial players is very hard to imagine. Equities of banks offer a discount of 20 % in their share price and represent the rear light on Wall Street. To be more exactly: This year the share price of financial institutions has declined about 22 %, representing the worst segment of S&P 500. The fear of further write-offs due to the so called subprime crises has decreased share prices heavily.

A couple of days ago I posted about the last deals of sovereign wealth funds and the activities related to banks (see this post). Now two new deals have been announced. The US investment bank Morgan Stanley had to announce new major cumulative value adjustments. 9.4 billion USD cumulative value adjustments had to be made related to credit derivatives. Hence the last quarter of 2007 faces a loss of 3.59 billion USD. To stabilize the situation in financial terms, CIC (China Investment Corp.) will invest around 5 billion USD (equal to a 9.9 % stake in Morgan Stanley). Instrument to do so is a convertible bond (9 % interest rate) that can be converted into an equity stake of 9.9 % later.

According to the Wall Street Journal the investment bank Merrill Lynch is in negotiations with Termasek Holdings (Singapore) about an investment of 5 billion USD. The share price of Merrill Lynch declined nearly 40 % this year. In the case that the negotiations would be successful, Termasek would have the option to get an equity stake over 10 %.

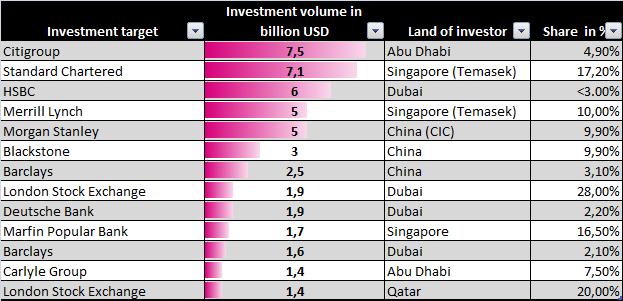

All recent deals have illustrated very well the growing importance of sovereign wealth funds in the Middle East and Asia. These deals also highlight the increasingly bold moves to take advantage of the need for capital among western institutions. To summarize all deals in financial institutions I have update the following table; it also include the effect of a successful negotiation between ML and Termasek:

Â

According to the Financial Times three deals (UBS; Citigroup and Merril Lynch) have yet to be endorsed by shareholders of each investment banks. The newspaper FT reported on Friday last week that in particular the Swiss UBS is confronted with a “shareholder revolt” over its planned re-capitalisation deal with GIC and the unknown investor based in Saudi Arabia. As posted before, I think that this investor might be Abu Dhabi (ADIA).

For another economic comments I also recommend this blog.

Â

Pingback: The world’s largest companies | Eddielogic

Pingback: Xanax without prescription.

May 19, 2009 at 11:30 am

The best real-estate investments with the highest yields are in working-class neighborhoods, because fancy properties are overpriced.

henrymaquli

real estate search