The establishment of a single market for services and goods – including banking – has for several decades been one of Europe’s core policy objectives. The way towards these objectives is termed integration process. The benefit of integration is to offer new business opportunities in Europe for the banks through more competition and the option to increase returns to scale. For customers integration offers EU access to a similarly broad and fair prices range of banking products. The potential segment regarding Pan-European retail banking has been estimated with approximately 40 million customers among EU-25. Across the markets for goods and services different levels of integration has been reached. COM (2007) argues that significant progress has been made in establishing a single market for retail financial services with the introduction of legal frameworks regarding financial soundness of retail financial service providers. However, according to DIECKMANN (2006), COM (2007), BDB (2008) and SCHÄFER (2009) one of the least integrated markets in the EU is retail banking. A full integration of retail banking markets would represent “a truly single internal market for retail banking products would imply consumer demand for bank services EU-wide and provision of these services EU-wide by banks”.

The establishment of a single market for services and goods – including banking – has for several decades been one of Europe’s core policy objectives. The way towards these objectives is termed integration process. The benefit of integration is to offer new business opportunities in Europe for the banks through more competition and the option to increase returns to scale. For customers integration offers EU access to a similarly broad and fair prices range of banking products. The potential segment regarding Pan-European retail banking has been estimated with approximately 40 million customers among EU-25. Across the markets for goods and services different levels of integration has been reached. COM (2007) argues that significant progress has been made in establishing a single market for retail financial services with the introduction of legal frameworks regarding financial soundness of retail financial service providers. However, according to DIECKMANN (2006), COM (2007), BDB (2008) and SCHÄFER (2009) one of the least integrated markets in the EU is retail banking. A full integration of retail banking markets would represent “a truly single internal market for retail banking products would imply consumer demand for bank services EU-wide and provision of these services EU-wide by banks”.

DIECKMANN (2006) and SCHÄFER (2009) describe several economic benefits of retail banking integration. In general integration can increase economic welfare due to two channels. The first reason is an intensified competition on formerly national markets. In an integrated market “foreign” retail banks are able to launch banking business there at any time. In this case consumers have a broader selection of better banking products at lower prices. Secondly market integration would enable banks to realise economies of scale if they could offer their banking products across the countries of the EU. This option would lower the costs of making their banking products. Furthermore the break-even point of innovations would be reduced. Economies of scale could also be achieved in risk management, since banks could diversify their risks more in a larger market, e.g. by offering personal loans in different countries. Furthermore a better integrated banking market should improve the competitiveness of EU financial centre globally.

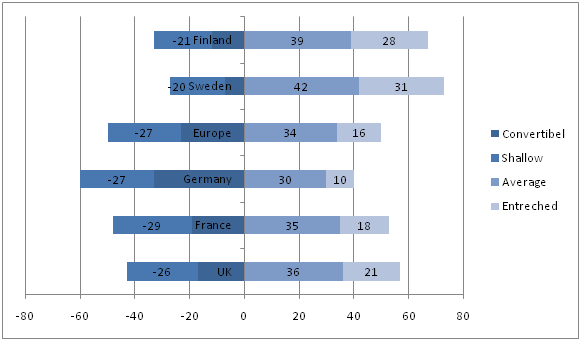

Despite several benefits on the European level consumers and banks are still focused on their national domestic markets when seeking or offering retail banking products. Surveys by the European Commission indicate that only 1 % of EU consumers buy financial services abroad at a distance; while 26 % of bank customers do so within their country by phone or internet. Of course, it has to be considered that the demand regarding “banking abroad” might be quite different. In Europe the commitment levels among customer differ widely across Europe:

According to this data from European Health Barometer and Schroder Salomon Smith Barney customers in Nordic Countries are fairly satisfied with their banking services. Opposite to this customers in Germany as well as in France and UK are less pleased with their banks and are highly interested in offers from external market players.

DIECKMANN (2006) sees other reasons for the low level of integration; he distinguishes between artificial and natural barriers. Artificial barriers are primarily set by legal issues, in particular regulatory. Potential regulatory barriers are set by the need for a bank to design its services with reference to up 27 different legal systems, i.e. consumer protection legislation, national taxations or particular civil law aspects. Moreover, “EU legislation is often open to different interpretation in different member states”. Natural barriers exist in terms of language, geographic nearness, and cultural preferences. New entrants have also a lower degree of brand awareness in comparison to long-established banks.

Trust related issues have also an impact on European retail banking. Trust in banks outside the familiar home market is very important on the customer side. In particular information on the services offered and their comparability, protection against low quality, cancellation options and possibilities of withdrawing from a banking contract have an impact on customer confidence. Uncertainty over their legal position establishes a barrier for buying products from non-national retail banks in the domestic market. As a result most customers still opt for services distributed locally through branches, intermediaries and subsidiaries.

However, there are some contradictions between banks’ needs and customer needs. SCHÄFER (2009) highlights that well-intentioned proposals to improve customer confidence may reduce the motivation to banks to offer their services outside their domestic markets.

In summary it can be argued that the process of market integration in retail banking has not come to a final stage. To improve integration it is recommended to harmonize the legal requirements for banking in general and to establish a level playing field. A specific emphasis should be given to a harmonization of customer protection policies and procedures.