In my previous posts I discussed certain aspects of trust. In this new post I will present a tool that might help your organization to deal with trust issues. The Internet – including its (social) media channels – is powerful force, but when it comes to money and personal finance, having a relationship with someone, customer trust still matters a lot. Customer trust represents one of the last competitive advantages of “off-line banks” since they are represented by more (i.e. real advisors) than just a website. We can summarize this “more” under the term “physical evidence”, i.e. a branch, personal contact, equipment, brochures.

According to Dayal, Landesberg and Zeisser (1999) customers focus on three different aspects when choosing their bank. They look

-

behind functional benefits (i.e. quality, price)

-

for process (better way to research and buy) and

-

relationship (trust, ongoing communications)).

The result for banks: the most valuable stock in trade for banks is consumer trust since the basic principle in the retail banking industry is an exchange of information (in the sense of a constant and interactive value exchange). Customers tell their financial advisors about their income (sometimes this also might include unreported earnings), tax rates and their savings. This information is the fundament for the recommendations by the advisor. If the bank wants to get this sensitive information it has to gain customers’ trust. That has always been the case, but on the Internet, where business is conducted at a distance and risk and uncertainties are magnified, it is truer than ever.

When customer do trust their online bank, they are much more likely to share personal financial information. That information enables the bank to form a more intimate relationship with its customers, offering products and services tailored to their individual preferences, which in turn will increase trust and strengthen loyalty. Allen, Kania and Yaeckel (1998) argue that the more you know about your customers, the easier it is to provide them with the things they value. Trust also is important to position the bank as an infomediary in order to own the customer contact as well as the customer relationship.

Due to the technological development there also is a new threat to the trust aspect. Customers are used to use search agents (“softbots”, “knowbots”) to find information on the Internet. Tapscott (2000b) expected that in many areas, trusting your agent will become synonymous with trusting your own experience; a development that needs to be addressed by the employment of e-business applications within the bank-customer relationship.

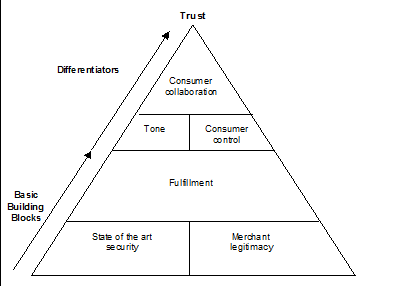

Dayal, Landesberg and Zeisser (1999) identified 6 elements that combination builds their trust pyramid.

Figure: The 6 elements of the trust pyramid (Source: Dayal, Landesberger and Zeisser (1999))

The bases of the pyramid are secure technology, merchant legitimacy, and robust order fulfilment. To differentiate banks have to consider tone, consumer control, and collaboration.