A couple of months ago I discussed in this post capital market issues and the cash flow that is created in specific nations trough commodities. Recently in some nations discussions are underway that focus on the financial power, which arise from “government investment funds†– also known as sovereign wealth funds – (in the sense that the government of a specific country has the majority or ownership to that fund or at least the ability to control the fund). Some nations see a threat that these funds would invest their capital in certain industries; furthermore some funds could be used as a “Trojan Horse†to control and to guarantee access to strategically important industries.

A couple of months ago I discussed in this post capital market issues and the cash flow that is created in specific nations trough commodities. Recently in some nations discussions are underway that focus on the financial power, which arise from “government investment funds†– also known as sovereign wealth funds – (in the sense that the government of a specific country has the majority or ownership to that fund or at least the ability to control the fund). Some nations see a threat that these funds would invest their capital in certain industries; furthermore some funds could be used as a “Trojan Horse†to control and to guarantee access to strategically important industries.

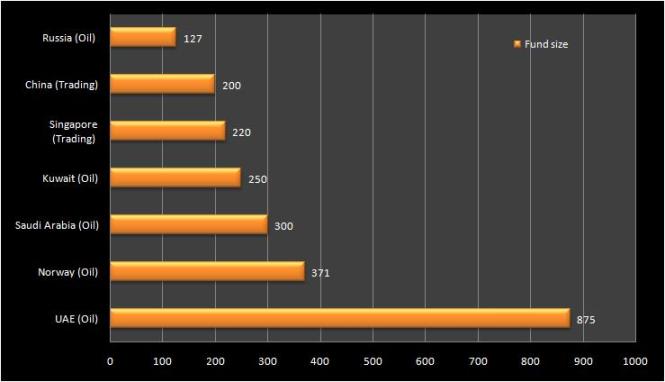

To understand these issues it is helpful to give an overview about the largest and most powerful funds.

- United Arab Emirates run the world’s largest investment fund, the Abu Dhabi Investment Authority (ADIA). The capital volume is 875 billion USD. ADIA invests in different asset segments including shares, bonds, derivatives, real estate, and private equity. Other government funds are Abu Dhabi Investment Council (ADIC) and Fonds Mabdala.

- Kuwait manages the Kuwait Investment Authority (KIA). KIA’s capital volume is 250 billion USD. The asset segments include government bonds, real estate and industrial interests. Every year the fund receives a government cash flow of 10 % income from oil. For 2007 Kuwait’s income from oil is forecasted for 57 billion USD.

- Singapore runs two investment funds (GIC, Ternasek). GIC has made investments in over 40 nations. Approximately 30 % of the funds have been invested in government bonds; other asset segments are real estate, shares, private equity and commodities. The total capital of these funds cannot be specified exactly, the range is from 220 up to 330 billion USD.

- China manages the CIC that has a capital of 200 billion USD. Source for Chinese capital investments is China’s trading surplus (1400 billion USD). Until 2011 it is expected that CIC will have a capital about 1000 billion USD. One of CIC first transactions was an investment in Blackstone with 3 billion USD.

- Norway runs the world’s second largest investment fund; the capital is 371 billion USD. 40 % of the fund is invested in foreign shares, 60 % in bonds. The fund is not allowed to invest in domestic companies. All in all the fund has shares of 3.000 companies worldwide and owns 0,4 % of all issued shares.

- In 2004 Russia started its stabilization fund with 100 billion USD. According to the Russian ministry of Finance the fund will receive additional capital about 130 billion USD in the next couple of months. Asset segments include USD-bonds, EUR-bonds and GBP-bonds.

Â

Â

Â

Â

Data source: Köhler, Peter; Afhüppe, Sven (2007): Die Macht des Geldes, in: Handelsblatt, 23./24./25. November; no. 227, page 2)

Pingback: Mortgage Business » Government investment funds

Pingback: lappen » Government investment funds

November 26, 2007 at 3:53 pm

Thank you very much for this article wich was very intructive.

Could I please provide me with some links where you got the informqtion from, notably the grafs, I was unable to find them by myself on the site of Handelsblatt.

Thank you very much again, you’re help would save my day!

November 27, 2007 at 7:14 am

Hello,

I have complemented reference information. I am note sure if you will find all data on the website, since I reference to the print versions. Best wishes.

Pingback: Trends of government investment funds at Eddielogic