well, before I start I have to explain that the term “second” here is equivalent to “another”. To be more specific, it is the bank’s second major strategic move to enter the lower retail banking market. One of German leading financial institutions, the Deutsche Bank, has started its associated company “Norisbank†to enter the German market for low cost retail banking. With a focus on price competition, the Norisbank has the objective to increase the number of its customers three times to 1 million at the end of this decade. The bank will focus on customers who have to take care for their financial belongings (“people who take low cost airlines to go to Rom and then shop with Pradaâ€). The organization will gain new customers with just a few financial products; those products will be at least under the top 3 of their product range in terms of price competition.

Opposite to this the Deutsche Bank with their brand will still focus on the premium segment of banking services.

The Norisbank was a former specialist and product provider for personal loans within the DZ Bank; offering personal loans and lean loan processes to the credit cooperatives in Germany. It has been a subsidiary to a large number of other enterprises in the past. In 2006 the Deutsche Bank bought the Norisbank, leaving only the loan business within the credit cooperative sector.

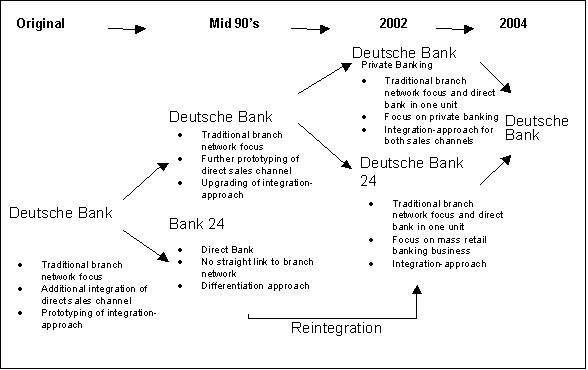

This launch can be described as the second attempt of Deutsche Bank to set up a new brand in the retail banking business. In the mid 90’s the Deutsche Bank started the “Bank 24†with an innovative concept to enter the lower segment of the retail market. The following figure illustrates the development of this approach.

Â

Â

Illustration: Strategic approaches and brand change at the example of Deutsche Bank (Source: Bartmann (2002), slide 7)Â

The former “Bank 24†can be described as an innovative approach, using a new brand and offering a wide range of sophisticated online services in order to attract younger customers and customers with a focus on modern technology. It was a second brand, but it was not positioned that much as a low cost brand. The established recognition included terms like “modern banking†and “technology driven bankingâ€. Customers who wanted to experience more traditional banking, kept with Deutsche Bank. Having a debit card of bank 24 had the meanings of being a modern bank customer.

In 199 the brand was changed into “Deutsche Bank 24â€. Deutsche Bank announced a two class system: Average (and below) retail customers should move to Deutsche Bank 24. Going this way the company destroyed both the modern brand of “Deutsche Bank 24†and the loyalty of their existing retail customers, which were move to another brand of the organization. Now, having a debit card of Deutsche Bank 24 had the meaning of being a “low wages customerâ€

Today the company describes itself as the “first quality discounter†in the German retail banking.

But I don’t think so. There is a large number of banks that targets the same market segment and offers comparable products and services. Furthermore, a variety of financial service providers from abroad have entered the German market in the last couple of years, too. It is possible to offer some extraordinary interest rates for some years and to employ a big wallet marketing approach when (such) a bank enters the market. But at the end of the day, retail banks income is still generated from net interest income and provisions. No retail bank was able to invent other return sources.

So, what is good and what is bad about the Norisbank approach?

There are some positive aspects:

- It represents a typical multiple brand approach with all its benefits. The Deutsche Bank still uses and protects its valuable brand “Deutsche Bankâ€; hence it is still possible to target the premium segment of the retail market; at the same time “Norisbank†is able to target other market segments. Customers will not be confused, since these company names do not indicate a relationship to each other.

- Norisbank can participate from a still going trend within retail banking, where customer shift some or even all their products and services from branch banks to so called direct banks. This trend is still there. One reason is that customers became familiar with online banking solutions in the last decade (e.g. in 2002 ING Bank had 1 million customers; in 2006 the bank achieved 6 million customers).

Â

But I see some negative aspects as well:

- First and for most: It is their second attempt to enter the same market…and Deutsche Bank failed last time (see illustration). It will cost some effort and “some†financial resources to compete against those direct banks that were able to win market share. A competitor, ING Diba, invests 100 million EUR per year in marketing.

- Norisbank will use a branch network and an direct bank approach. Due to the branch network the organization has to accept fix costs in their P&L. That feature does not fit completely to the strategy of being a discount bank. Cost burdens will arise from both material costs (equipment and rent) and labour costs (bank consultants in office). Hence it can be expected that the customer has to pay his fees one way or the other to ensure bank’s profitability.

- Other branch banks (e.g. savings banks and credit cooperatives) are likely to protect their claim. They have lost and still lose customers and business to direct banks, have they can not afford to loose against another type of branch banks. In the last couple of years these banks have developed some approaches to respond the competition by direct banks.

Having said this, I think that Norisbank will face major challenges. So far, a source for a competitive advantage can not be identified from outside. Furthermore it can be expected that both established branch banks and direct banks will defend their markets.

Pingback: MoneyQs » Blog Archive » Deutsche Bank enters the market with second brand

Pingback: banks » Deutsche Bank enters the market with second brand

Pingback: Vicodine on line.

January 11, 2011 at 12:32 pm

It’s pretty funny to read news from 3 years ago where nobody could imagine, that there will be a huge financial crisis waitin around the corner…