Deutsche Bank has announced its new strategy on 27 April, 2015. Will this one be the big step forward that finally repositions the bank as a profitable global player? I have my doubts. In order to understand why, we first have to look back at Deutsche Bank’s Strategy 2015+ that was announced in 2012.

Deutsche Bank’s Strategy 2015+ revisited: Ups!

What was the plan?

I wrote a post about Deutsche Bank’s Strategy 2015+ back in September 2012. Even then, I was not that impressed by their strategy. However, I acknowledged that the bank was facing some sort of transition period and external pressure. Hence, I concluded that this strategy

reflects not so much what the bank wishes to achieve over the next couple of years, but what it needs to do in order to meet external requirements, and what it feels able to achieve under the given circumstances.

Here are the key points from 2012

- Strong commitment to the universal banking model

- Goal to become the leading client-centric global universal bank

- Change of corporate culture, changes in bonus payment model

- Reinforce capital base

- Reduction of risk-weighted assets from non-core activities

- Operational excellence with major reductions in costs (infrastructure, new integrated IT-platforms, rationalizing back-office activities)

- Post-tax return on equity (RoE) of at least 12% by 2015

What did they achieve?

Deutsche Bank actually did achieve some of their objectives. As announced, they have changed their bonus system and have worked on their culture. As of 31 December 2014, there are some promising financials

- Risk-weighted assets have been reduced by EUR 84 bn compared to 2012

- The equity ratio is 11.7% and thus considerably better than the 10% target for 2015

- Profit before tax is up to EUR 3.1 bn EUR

However, not everything worked out as planned. Profitability and costs remain major problem areas.

- RoE went up from 0.5% in 2012 to 2.7% in 2014 – which is far below the objective 12%.

- Cost-income-ratio went down from 92.5% in 2012 to 86.7% in 2014 – here the objective was 65%.

All in all, Deutsche Bank made some progress during the last 2 and half years. They are, however, still far away from the profitability they need to successfully compete in the global arena.

Back in 2012, one could expect that the bank would by now be in a position to present a true growth strategy. Unfortunately this is not the case.

So let’s take a look at their new strategy:

Deutsche Bank’s new strategy

What is the plan?

What has remained is their commitment to being a leading global universal bank based in Germany. They still emphasize their customer-centric approach (What else could a bank claim to be?)

Here are the other main points from their Press release:

- Deleveraging the Corporate Banking & Securities business – CB&S

Aiming further to de-emphasize lower-return businesses … and invest in growth in higher-return products - Focusing retail business on a market-leading advisory-led proposition

- Deconsolidating Postbank

- Investing up to EUR 1 bn do deploy digital technologies – to capture new growth opportunities, … realize platform efficiencies …, and develop new client propositions

- Refocusing the global footprint, reducing the number of countries or local presences by 10-15%

- Transforming the Bank’s operating model by reducing complexity, increasing controls and boosting efficiency with the aim of delivering additional annual gross savings of EUR 3.5 bn

Medium-term financial ambitions

- Increasing leverage ratio to at least 5%

- Stabilizing the CRD 4 fully loaded Basel 3 Common Equity Tier 1 ratio at approximately 11%

- Cost/income ratio of approximately 65%

- Post-tax return on tangible equity in excess of 10%

- Aspiration: Payout ratio to shareholders of 50% or more

How does this compare to the previous strategy?

In the following chart, I compare key points from the previous and the actual strategy.

| Strategy 2015+ from 2012 |

Strategy through to 2020 from 2015 |

Degree of change |

| Universal banking model | Universal banking model | Essentially unchanged |

| Customer-centricity | Customer-centricity | Essentially unchanged |

| Change of corporate culture and bonus payment model | Is implemented | |

| Global bank | Global bank, but reducing the number of countries / local presences by 10%-15% | Still global, but at a lower level |

| Reduction of risk weighted assets for non-core activities | De-emphasize lower-return businesses and invest in higher-return products, reduce gross leverage of CB&S by app. EZR 200 bn |

Continuing reduction of RWA, focus shifted from core/non-core to profitability |

| Operational excellence with major reduction in costs | Further transforming the operational model for additional cost savings | Continuing and new cost reduction initiatives |

| Newly integrated IT-Platform as a means of cost reduction | Invest in digital technologies to capture new revenue opportunities | Further development of IT systems, focus shifted to business opportunities |

Is that the big step forward?

Once again, I am inclined to write that this is a perfect example for a strategy that tis driven by external forces. You can summarize the strategy as follows:

Shrink the least-profitable areas of business in order to meet capital requirements and to increase the profitability of the remaining businesses. As supplements, there are additional cost savings and further investments in technology.

Don’t get me wrong. All this makes sense. There is nothing wrong with refocussing on more profitable activities and abandoning others. However, this is the second consecutive strategy that is not primarily focused on growth, but on restructuring, repositioning and regaining profitability. Starting from 2012 through to 2020, this is a fairly long transition period.

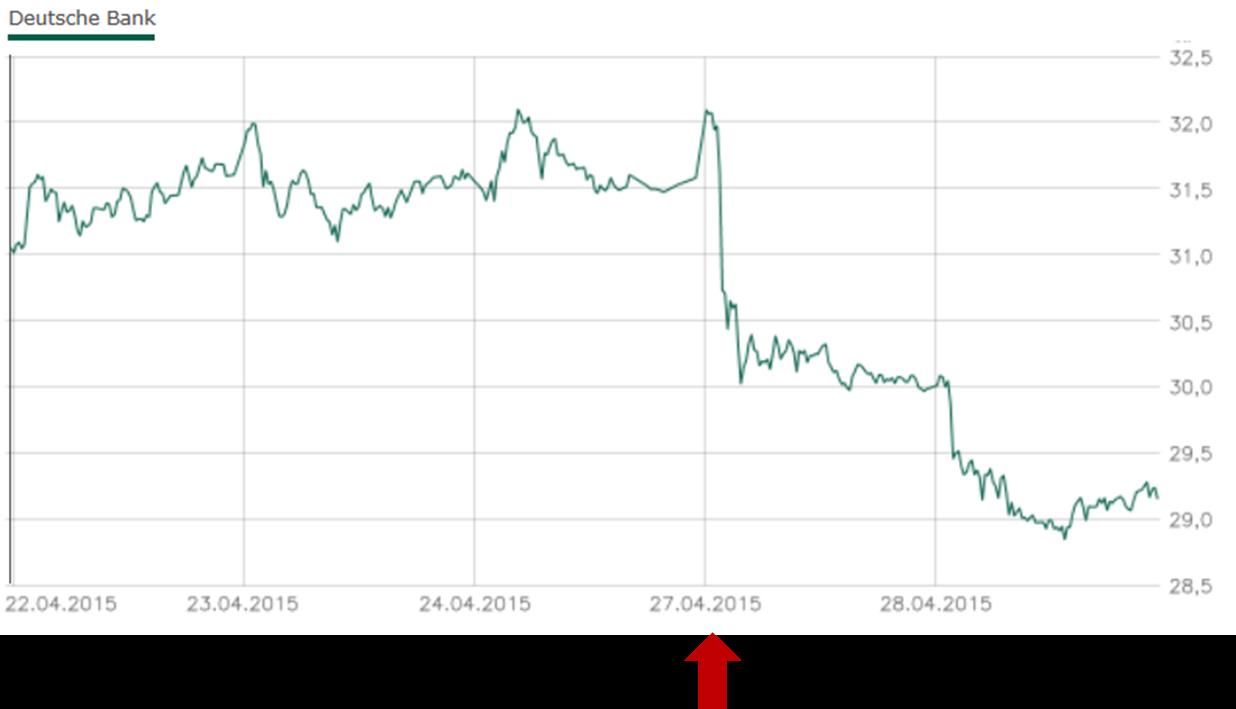

Stock markets seem to be as disappointed as I am:

The new strategy is basically a continuation and adjustment of the last one:

- Since the last strategy did not lead to the expected levels of profitability, they continue to work on that and take it one step further. They are now willing to abandon additional businesses, such as geographic markets, that are less profitable

- Thy plan even more cost savings

- They are still focusing on the universal bank model and customer-centricity, since there is not much else they can do without completely transforming the bank into something new.

This is no convincing perspective. This is, once again, more reactive than proactive.

Not even the strategy to ‘become a more digital bank’ is a real strategic approach. The digitalization of financial markets is an ongoing process that forces all financial institutions to continuously invest in technology. This is not a strategic initiative to capture new revenue opportunities; this is just a necessity in order not to fall behind.

In my view, there is even more fluff, as Richard Rumelt calls this sort of statements in Good Strategy Bad Strategy: The Difference and Why It Matters. Here are my favorites:

In the press release it says

… we are convinced that pursuing a focused client-centric business model is the right choice for us. This business model, which is unique to Deutsche Bank …

Did I understand this correctly – a focused client-centric business model is unique to Deutsche Bank? Do a Google-search and you will find:

- A lot of writings from notable consultancies that highlight the importance of banks having a customer-centric business model

- A range of banks claiming to be focused and customer-centric

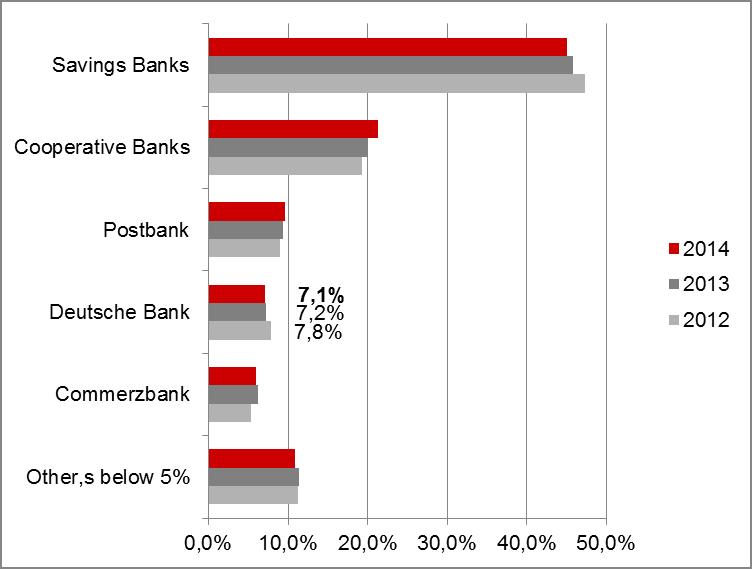

The Private & Business Clients (PBC) business ‘aims to remain a leader in Germany …’. This is their retail and small business section. I am not sure how they define ‘a leader’. I am, however, sure that Deutsche Bank is far from being the market leader in retail banking in Germany. I found a survey on the banks at which Germans maintain a personal current account:

Adapted from Statista

As for the Digital Bank issue, the press release says

The Bank plans to invest up to EUR 1 billion additionally over the next three to five years in digitization to capture new revenue opportunities, for example, through remote advisory channels; realize platform efficiencies through automated or digitized processes; and develop new client propositions.

Again, there is nothing wrong with this approach – except, that it is not a groundbreaking proactive strategy. The digital transformation of our lives and of the business world has never stopped. Customers are more willing and able than ever to approach their bank through various digital channels. New technologies open up new business opportunities:

What else can a bank do than to continuously invest in digitalization?

My conclusion

Deutsche Bank’s latest strategy is a logical continuation of its previous strategy. Strategic continuity in itself is not bad. In most cases it is more harmful to perform major strategic shifts every few years.

However, here we observe the continuance of a transition strategy. Once again, the strategy is more about consolidation and savings, than about orientation towards new growth areas.

What I miss is a clear idea, how Deutsche Bank intends to close the gap with the more successful global market leaders in terms of growth and profitability.

Such an extended transition strategy includes some risks:

- The longer it takes to catch up with the market leaders, the more difficult it will become.

- Major stakeholders might soon lose their patience. Shareholders and financial markets might demand a more progressive growth strategy.

- The abandoning of businesses and regional markets may harm key customers’ perception of a reliable partner.

- Ongoing cost savings and reductions in the branch network always harm employee morale. Without some quick wins it will become more difficult to motivate the people who work for Deutsche Bank for this strategy.

I am really curious to see what results and achievements Deutsche Bank can report by 2020.